As 2020 draws to a close I find myself looking back and reflecting.

Despite being a year unlike any other in living memory, “Santa Baby” looks likely to deliver many investors a gift that they could not have imagined during the early stages of the crisis – profits. He has been helped by the Central Banks elves who both lowered interest rates and bought assets with freshly printed money.

The elves’ generosity means that stock market investors have received three distinct gifts:

- Low interest rates which make owning shares in a company more attractive, as the dividends they pay look increasingly appealing.

- Low interest rates which reduce a company’s cost of making debt interest payments, leaving more of their revenue in the pockets of shareholders.

- Newly printed money for bond purchases which decreased their supply and in turn left investors with fewer alternatives to owning shares.

We go into 2021 with the world’s major economies having seen record falls in GDP, yet with financial markets reaching for new highs. The three reasons above provide some of the strongest justifications for not worrying that market valuations look high with respect to history.

So, if interest rates are set to stay low, what have we got to worry about?

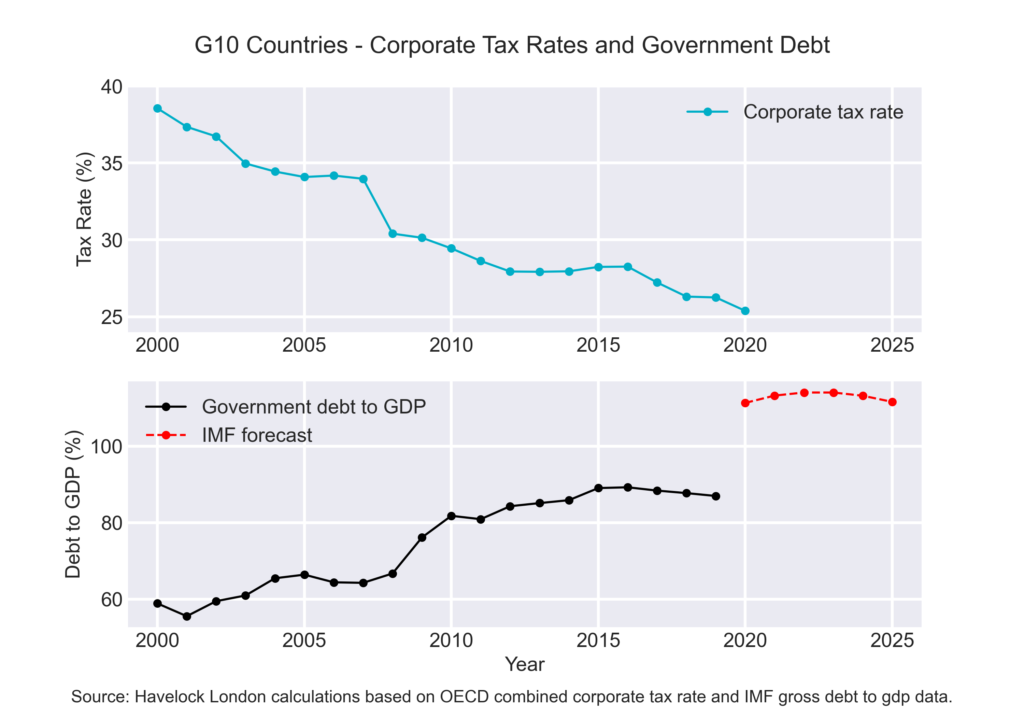

The financial burden of the pandemic has been shouldered by Governments, meaning they have become increasingly indebted. This is set against a backdrop of falling corporate tax rates reducing Government revenue. This is illustrated in the chart below that shows average corporate tax rates for G10 countries together with the ratio of government debt to GDP. It is a picture that speaks for itself.

The cost of stimulus cheques and job support schemes have been, and are still being, funded centrally. At the same time asset owners by-and-large are having their cake and eating it. It seems that Governments are “socialising” losses and “privatising” gains, funded by the gift of printed money. This, intuitively, troubles me. Whilst I enjoy a free lunch, like many observers, I feel that something must eventually give.

Given the current economic fallout there are many people who will go into the new year facing unemployment or frozen pay. For them, this years’ political and economic support for asset owners will seem unjust. My message for any investor fixating on this year’s gifts is that Governments might yet decide that it is not better to give than receive.

If Governments find that they cannot borrow endlessly they will be under pressure to plug their financial holes and asking asset owners to help, via increased taxes, seems like a distinct possibility. Whilst low interest rates justify higher market valuations, higher tax rates will have the exact opposite effect. I believe many investors are relying on the former whilst ignoring the latter.

What does this all mean?

For us, we proceed with caution in the belief that market valuations that look high with respect to history present a risk. Whilst there are reasons for it to persist, we see pressures building in society that could threaten the status quo. To this end we will continue to strive to own a portfolio that will be robust in a range of future scenarios.

On behalf of Neil and myself I will end by saying thank you to all our supporters. In the words of the song, I hope that Santa Baby hurries down your chimney. Even if he does not bring you a yacht, duplex, outer space convertible or deeds to a platinum mine, I hope you at least get a nice pair of socks!