It was a clean sweep in 2024!

Havelock London, and the WS Havelock Global Select Fund, were the ‘Most Searched Fund Groups’ and ‘Most Viewed Active Funds’ in every Quarter of 2024.

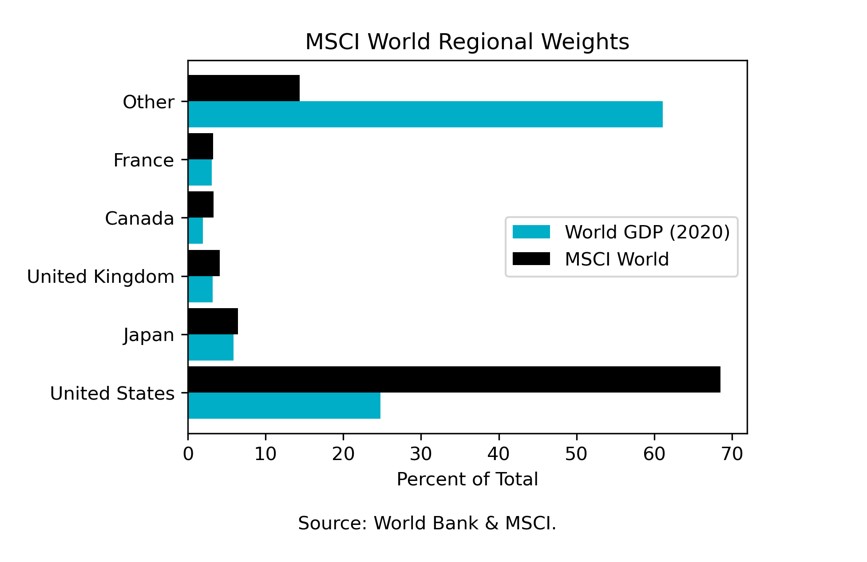

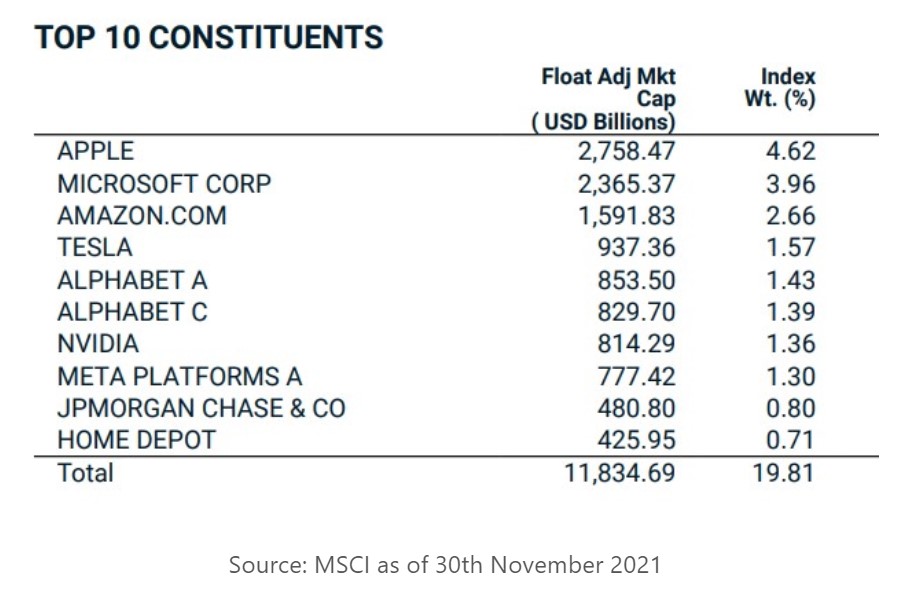

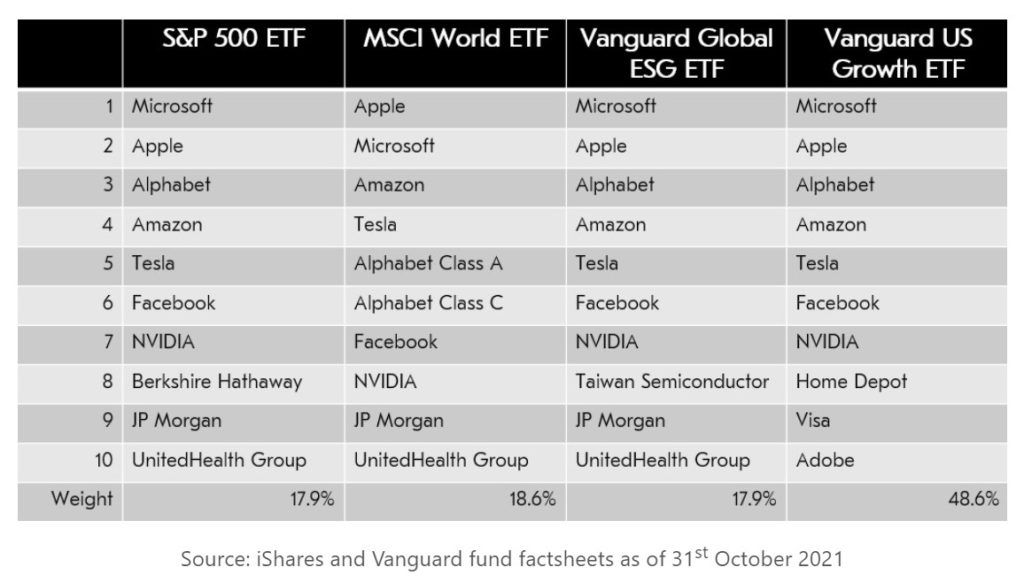

We believe that we offer a ‘different and useful’ exposure from a market-cap, geographic and company specific perspective, and please don’t hesitate to get in touch if you require more information.