The extent to which a small number of large companies supported the major stock index returns in 2021 has been well written about in the financial press. For example, a recent Bloomberg article told how the “number of Nasdaq stocks down 50% of more is almost at a record” with “40% of index’s firms having fallen by half from one-year highs”.

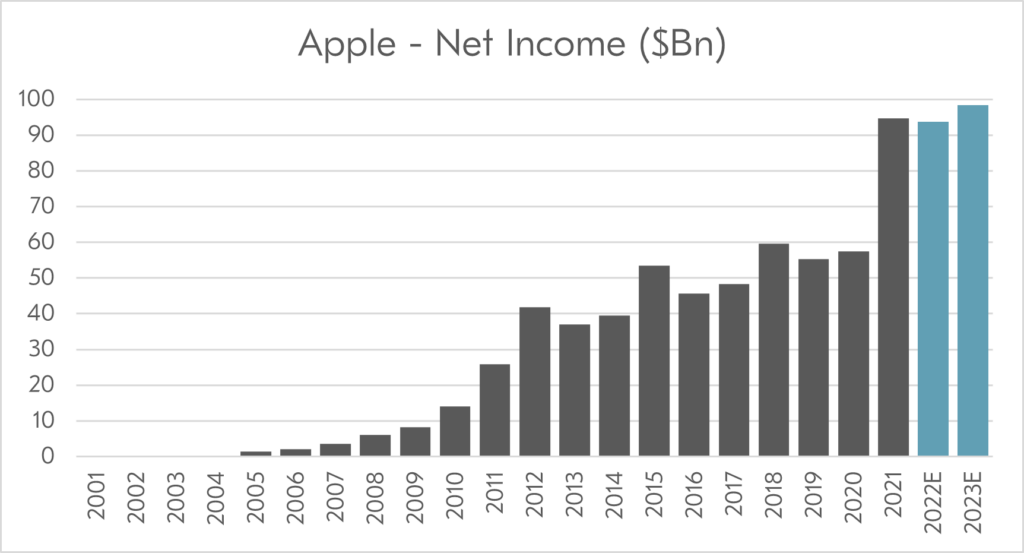

As of writing the 10 largest Nasdaq stocks account for more than 50% of the index, with the largest company, Apple, having recently hit a $3 trillion valuation. Apple is an impressive company, and one that, via Berkshire Hathaway’s holding, we have some exposure to. It has been a clear beneficiary of the lock down economy and has seen a year of “bumper” profits. The chart below shows a history of the company’s net income or earnings, together with the average analyst forecast of the next two years.

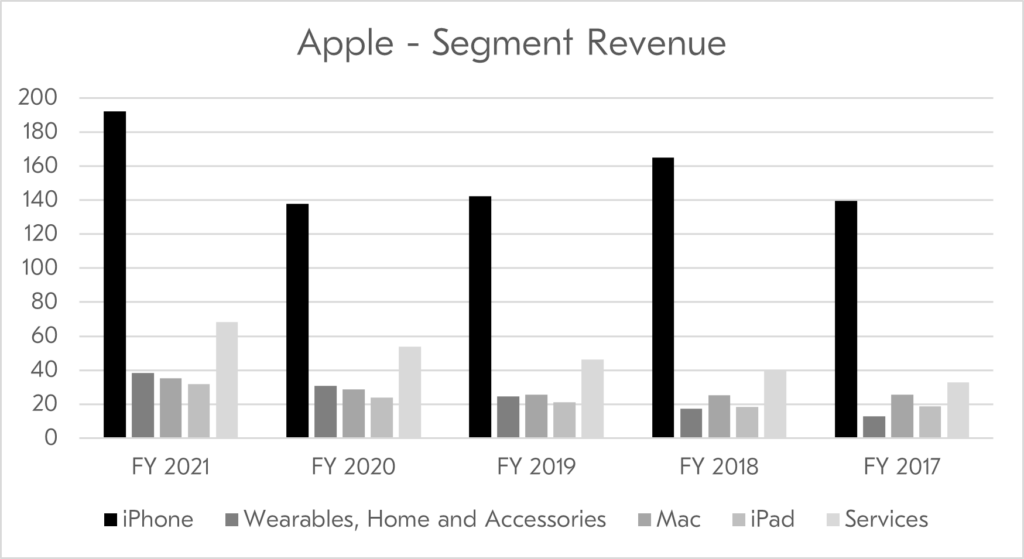

The next chart shows the company’s revenue by line of business for each of the last five years. This shows how the “services” revenue has been growing as we all watch more movies and download more apps from Apple. It also shows how sales of their iPhone are the dominant source of revenue, and one that had a big lift in the last year.

Apple’s share price is currently around 30x the value of its earnings. Prior to 2020 the company had spent ten years during which this ratio was almost always less than 20x. Furthermore, its most recent earnings are substantially higher than it has ever seen before, arguably helped by lots of lock-down induced iPhone purchases.

In my experience, it is a fundamental human tendency to like to extrapolate recent history into the future. This makes good sense as it is a good heuristic for many aspects of life. I believe that stock analysts are particularly susceptible to this, with company forecasts for the near future typically being “like last year plus a bit”.

The risk I see in owning a company, like Apple, at its current price is that not only are you susceptible to its price earnings multiple reverting back to historic levels (which would equate to a circa 30% price fall), but to the company struggling to deliver results that match last year’s “blow out” success. This is the type of situation that I am happy to leave to other investors with a more optimistic disposition than my own.