It is with great pride that I look back on the first year of the LF Havelock Global Select Fund’s life. In this time there have been two distinct phases of performance. Firstly, a wave of negative sentiment sent a chill through equity markets in the autumn of 2018, with falling prices leading to negative performance. These concerns melted away during 2019, with a buoyant mood driving equity prices higher and helping the fund recover its losses and make new highs.

The fund was well placed to weather the storms at the end of last year, owing to the amount of dry powder it held in the form of cash and government bonds. This was determined by us having conservatively set the “volume control” which drives how capital is invested into company shares. We made this decision because market valuations were high relative to history, and in the belief that our opportunities for investment were likely to improve. The combination of prices generally falling, and us completing further new investment research, led us to increase the volume control, which increased the fund’s holdings of equities in time to benefit from the general uplift in markets.

The US economy has experienced its longest period of economic expansion on record. A widespread belief that central banks will support markets if the world’s major economies contract, has led many investors to be complacent about the risk of financial loss and helped push stock markets to new highs. This rising tide lifted all ships, and so contributed to the fund’s positive performance in the first half of 2019.

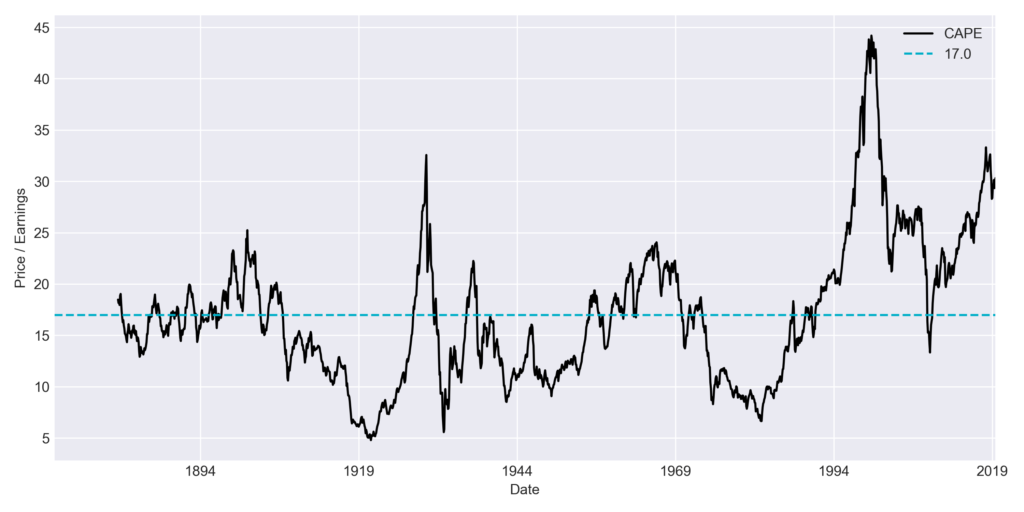

The chart below shows the Shiller PE ratio, which is the ratio of prices to average earnings in the last 10 years for companies in the S&P 500 index. This metric has been widely touted as evidence for why valuations are at worryingly high levels, with current low interest rates forming the major defence of why such high valuations can be sustained.

Our own analysis suggests that valuations have become even more stretched for the most expensive stocks. To rank as one of the ten percent of most expensive US companies it currently requires a price earnings ratio above 60. At no point during our 60-year study, including during the dot-com boom, was this higher. It follows that many market participants are willing to pay a hefty premium for high quality or high revenue “growth” companies, in the belief that future profits will give them “jam tomorrow”. This bears some resemblance to the so-called Nifty-Fifty stock market boom of the late 1960s and early 1970s, where a bubble emerged amongst a small and concentrated group of large companies.

The narratives used to justify current high valuations both generally and with respect to high growth and high-quality companies have hallmarks of “this time it is different” about them. The risk to asset owners is that the world cannot sustain a low-interest rate, low-inflation and high profit growth environment, and that something must “give”. Furthermore, the Nifty-Fifty stock market boom provides some cautionary lessons on the risk of investors’ believing that valuations cease to matter for the “best” companies.

In the short-term the fund’s performance will be impacted by the sentiment of others in the markets, but in the longer term we believe that it will be driven by the performance of the businesses that we choose to buy. Our twin lines of defence against the current risks we see is to continue to hold some dry-powder, and only own stakes in sound businesses where undue optimism is not required to justify their purchase price. With hindsight an all-out bet on high-growth companies would have been more profitable than our own cautious stance so far in 2019, but our resolve to maintain our approach is, nonetheless, unchanged.

We believe that the current high tide is unlikely to never recede, but we cannot predict when it might turn or how far out it might travel. We move forward into the remainder of the year in the belief that our investment approach will leave our ship well placed to weather future storms.

Footnotes

[1] Data courtesy of Prof Robert Shiller (http://www.econ.yale.edu/~shiller)

Important information

Please ensure you have read this important information. The value of investments in WS Havelock Global Select may fall as well as rise. Investors may not get back the amount they originally invested. Investments will also be affected by currency fluctuations if made from a currency other than the fund’s base currency. Past performance is not a reliable indicator of future results. Potential investors should not use this website as the basis of an investment decision. Decisions to invest in WS Havelock Global Select should be informed only by the fund’s Key Investor Information Document (KIID) and prospectus. Potential investors should carefully consider the risks described in those documents and, if required, consult a financial adviser before deciding to invest. WS Havelock Global Select can invest more than 35% of its value in securities issued or guaranteed by an EEA state listed in the prospectus. The KIID and prospectus are available in English from this website and from Link Fund Solutions.

This website is not intended for any person in the United States. None of Havelock London’s services or related funds is registered under the US Investment Company Act of 1940 or the US Securities Act of 1933. This material is not an offer to sell or solicitation of offers to buy securities or investment services to or from any US person.