‘The four most expensive words in the English language are: ‘This time it’s different.’’

Sir John Templeton.

Amid another lockdown here in the UK, we must all look for new ways of entertaining ourselves at home. In a clear sign of lack of imagination, my source of extracurricular entertainment this week was to revisit the “Nifty Fifty” stock market boom of the 1970s.

The, so called, Nifty Fifty were a group of popular “Blue Chip” companies where there was a widely held belief that their solid prospects meant that they were “one decision” investments to be bought, and held, at any price. The stock market crash of 1973 and 74 made owning these companies suddenly seem less comfortable. There has been much debate as to whether their lofty valuations were justified, or if it was a speculative bubble. Either way, many investors who purchased shares at high prices had to endure a wait of five, or more, years to recoup their losses.

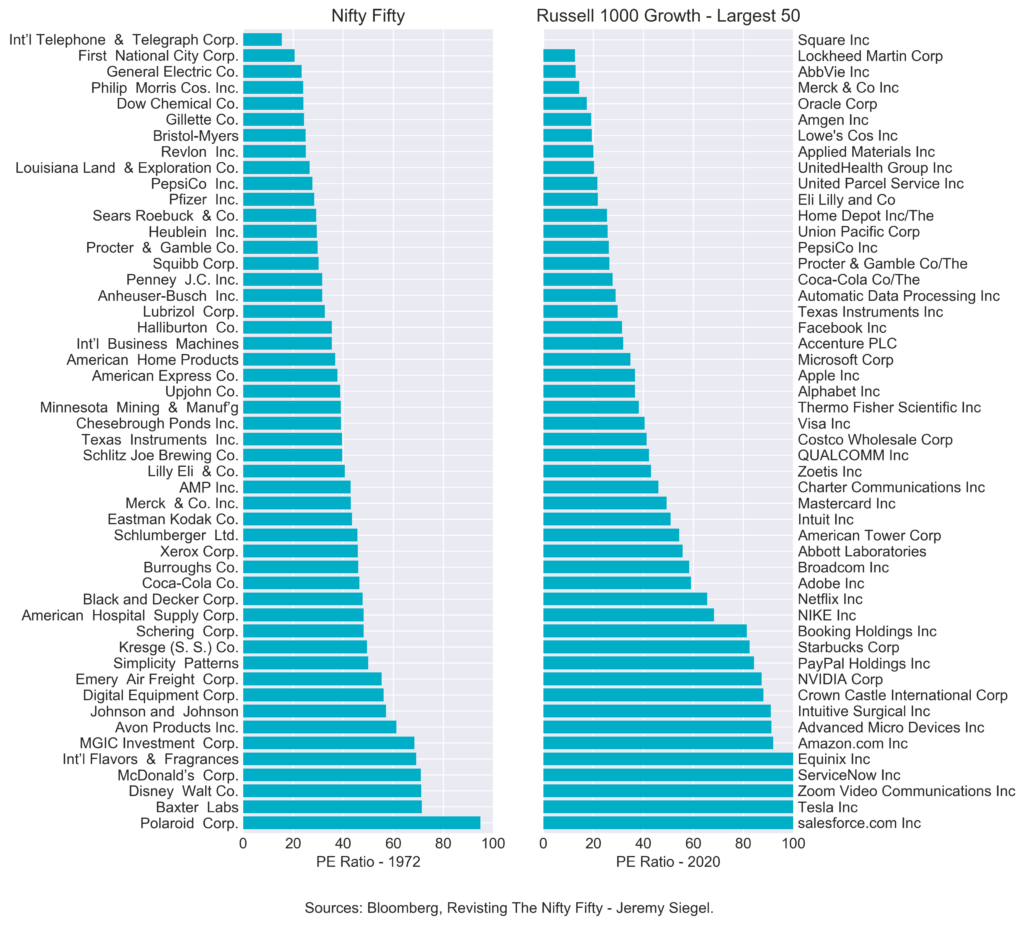

The enthusiasm we currently see for large “growth” companies is, to me, eerily reminiscent of the early 1970s. This is illustrated in the chart below, that compares price earnings ratios of the Nifty Fifty companies in 1972 to the 50 largest US growth companies today.

Does this imply that these businesses are overvalued? I wish I knew. What I do know is that “value investors”, like me, avoid businesses where the purchase price requires undue optimism about the company’s future. The more expensive an investment is relative to its underlying economics, the greater the risk of future disappointment. I would suggest that this is not the right moment to make an all-in bet on this time being different and that value investors, like us, could offer some diversification if today’s Nifty Fifty were to disappoint.